Executive Summary

Given the importance of the Affordable Care Act (also called the ACA or Obamacare)The official name of the health care reform law passed during Obama’s administration is H.R. 3590 – Patient Protection and Affordable Care Act. and the controversy over negotiations on health care reform, this report looks back on the passing of the ACA to see if the process that led to the ACA becoming law sheds light on the current health care reform negotiations.

This report sets out to research, through government documents and media reports, how the ACA evolved to offer an answer to the question:

Was the ACA (Obamacare) negotiated by the Democrats in secret and did they keep Republicans out of that negotiation process on purpose?

The road to passing the ACA was not a short or easy one, especially considering that for decades prior to Obamacare others had tried to pass national health care reform legislation but failed. President Bill Clinton passed the Health Security Act in 1993, and President George W. Bush passed the Medicare Modernization Act in 2003, but those attempts at health care reform were limited.

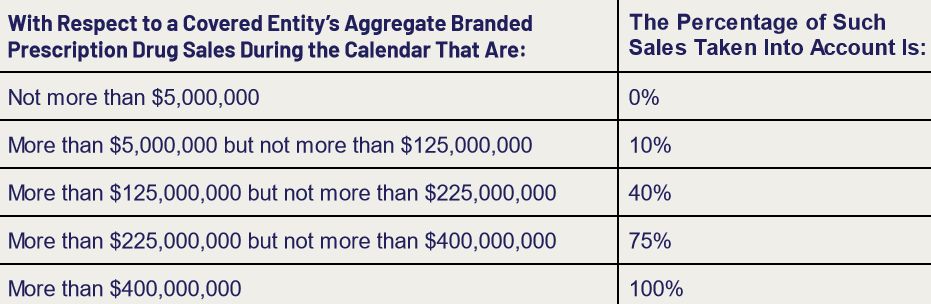

In the end, it took President Obama 427 days“This is equal to 1 year, 2 months, and 3 days,” according to ConvertUnits.com. from the day he was inaugurated on January 20, 2009, to March 23, 2010, to get the ACA (Obamacare) passed. To try to balance the ACA’s cost, the bill contained 19 different taxes [revenue enhancements].See Appendix B

The Senate passed H.R. 3590, the Patient Protection and Affordable Care Act, on Dec. 24, 2009, by a vote of 60 to 39 (59 Democrats and 1 Independent voted for the bill while 39 Republicans voted against the bill, with 1 Republican not voting).

On March 21, 2010, the final House vote was 219 to 212 to approve H.R. 3590,Bills that start with the prefix “H.R.” are House Bills, bills that started in the House of Representatives and the prefix “S.” is for Senate Bills – “A bill is a legislative proposal before Congress. Bills from each house are assigned a number in the order in which they are introduced, starting at the beginning of each Congress (first and second sessions). Public bills pertain to matters that affect the general public or classes of citizens, while private bills pertain to individual matters that affect individuals and organizations, such as claims against the Government.” “ABOUT CONGRESSIONAL BILLS,” gpo.gov, accessed 7/9/2010 with every House Republican voting no.Shailagh Murray and Lori Montgomery, “Senate Passes Health-Care Bill, Now Must Reconcile It with House,” WashingtonPost.com, Dec. 25, 2009 The final vote of the 431 representatives (there were four vacant House seats at the time) included 219 Democrats voting for the bill, and 34 Democrats and 178 Republicans voting against the bill.GovTrack.us, accessed 7/9/2017

On March 23, 2010, Obama signed the 906-page ACA into law.

Three Republican Comments on the ACA (Obamacare) Process in 2009 and 2010

- “This [health care reform] is a very important issue. We shouldn’t try to do it in the dark. And whatever final bill is produced should be available to the American public and to the Members of the Senate certainly for enough time to come to grips with it. There should be and must be a CBO score.”

– Sen. Mitch McConnell, then-Republican Senate Minority Leader, C-SPAN, Oct. 2, 2009 - “It’s simply wrong for legislation that’ll affect 100% of the American people to be negotiated behind closed doors…”

– Rep. Mike Pence, then-Congress member (R-IN-6th District) and future Vice President, Twitter, Jan. 13, 2010 - “Join our effort to stop closed door health care negotiations by signing the petition …”

– Sen. Richard Burr (R-NC), Twitter, Jan. 13, 2010

An Overview of Some Federal Health Care Reform Initiatives Prior to the Obama Administration to Jan. 20, 2009

Prior to the Affordable Care Act (Obamacare) becoming law on March 23, 2010, there had been other efforts at federal health care reform. Starting with President Bill Clinton’s administration on Oct. 27, 1993, here is a timeline of some of the more major efforts on health care reform leading up to President Obama’s inauguration on Jan. 20, 2009:

Oct. 27, 1993: President Bill Clinton presents his 1,342-page Health Security Act, which took nine months to craft.Robert Pear, “CLINTON’S HEALTH PLAN: The Overview; CONGRESS IS GIVEN CLINTON PROPOSAL FOR HEALTH CARE,” NYTimes.com, Oct. 28, 1993 The bill was dubbed “HillaryCare”Susan Cornwell, “From ‘Hillarycare’ Debacle in 1990s, Clinton Emerged More Cautious,” Reuters.com, June 6, 2016 after the First Lady, who was responsible for leading the effort. It failed.

Aug. 5, 1997: The Children’s Health Insurance Program (CHIP) is created in “Title XXI – State Children’s Health Insurance Program”GovTrack.us, accessed 6/22/2017 of the Clinton administration’s Balanced Budget Act of 1997 (H.R. 2015),“CHILDREN’S HEALTH INSURANCE PROGRAM OVERVIEW,” National Conference of State Legislatures, 1/10/2017 which became Public Law No: 105-33.

Feb. 11, 2003: Rep. John Conyers, Jr. (D-MI) introduces his Expanded and Improved Medicare for All Act for the first time, and continued to submit the previously failed bill as of Jan. 24, 2017.

Dec. 8, 2003: The Bush administration’s Medicare prescription program, H.R.1 – Medicare Prescription Drug, Improvement, and Modernization Act of 2003, becomes Public Law No: 108-173.Congress.gov, accessed 6/23/2017 The House vote of Nov. 22, 2003, is 220 to 215 on Nov. 22, 2003. Voting for the bill were 204 Republicans and 16 Democrats, and voting against the bill were 25 Republicans, 189 Democrats and 1 Independent. The Senate vote of Nov. 25, 2003, is 54 to 44, with 42 Republicans, 11 Democrats, and 1 Independent voting for, 9 Republican and 35 Democrats voting against, and 2 Democrats not voting.GovTrack.us, accessed 7/19/2017

Feb. 15, 2006: President Bush, in a letter included in the White House National Economic Council report titled “Reforming Health Care for the 21st Century,” writes:

“America’s health care facilities and medical professionals are the best in the world. Keeping our Nation competitive requires affordable and available health care.”GeorgeWBush-WhiteHouse.archives.gov, accessed 7/24/2017

The report states some of Bush’s initiatives including Health Savings Accounts, speeding generic prescription drugs into the marketplace, expanding community health centers, and that in 2004 he “launched an initiative to make electronic health records available to most Americans within the next 10 years.” Another of the president’s proposals was for allowing “the purchase of health insurance across state lines.” None of those initiatives became law.

Jan 18, 2007: Sen. Ron Wyden (D-OR) sponsors, and Sen. Chuck Grassley (R-IA) co- sponsors, “S. 334 (110th): Healthy Americans Act,” “A bill to provide affordable, guaranteed private health coverage that will make Americans healthier and can never be taken away,” which dies in Congress,GovTrack.us, accessed 7/19/2017 and is reintroduced as “S.391 – Healthy Americans Act,” Feb. 5, 2009. As of July 9, 2017, this bill has not become a law.

Jan. 23, 2007: During his State of the Union speech, President Bush proposes “two new initiatives to help more Americans afford their own insurance.”The White House, “President Bush Delivers State of the Union Address,” georgewbush-whitehouse.archives.gov, 1/23/2007 According to the White House website: “The President’s Plan Includes Two Parts: Reforming The Tax Code With A Standard Deduction For Health Insurance So All Americans Get The Same Tax Breaks For Health Insurance And Helping States Make Affordable Private Health Insurance Available To Their Citizens.”“Affordable, Accessible, And Flexible Health Coverage,” George W. Bush – White House Archives, accessed 6/24/2017 Neither of these initiatives became law.

Jan. 25, 2007: President Bush participates in a roundtable on health care initiatives with Saint Luke’s Health System in Missouri while seated in front of a background stating “Affordable Health Care.”“President Bush Participates in a Roundtable on Health Care Initiatives,” George W. Bush – White House Archives, accessed 6/24/2017

Feb. 8, 2007: In a Ways and Means Committee “Hearing on the President’s Fiscal Year 2008 Budget for the U.S. Department of Health and Human Services,” bipartisan members were involved with talks about Bush’s health care initiatives, among other items.

Feb. 13, 2007: “Finance Committee Chairman Max Baucus (D-MT) outlines the principles for health care reform before the National Health Policy Conference.”“Health Care Reform from Conception to Final Passage: Timeline of the Finance Committee’s Work to Reform America’s Health Care System,” Finance.Senate.gov, accessed 7/24/2017

May 29, 2007: Then-presidential candidate Barack Obama proposes health care reform in a campaign speech:

“The time has come for universal, affordable health care in America.”Scott Conroy, “Obama Unveils Universal Health Care Plan,” CBSNews.com, 5/29/2007

May 6, 2008: First hearing on the Senate Finance Committee’s Series on Health Care Reform in 2008 is held, followed by ten more for a total of 11:US Senate Committee on Finance website, accessed 6/21/2017

- May 6: Seizing the New Opportunity for Health Reform;

- June 3: Rising Costs, Low Quality in Health Care: The Necessity for Reform;

- June 10: 47 Million & Counting: Why the Health Care Marketplace is Broken;

- June 17: Crisis in the Future: Long Run Deficits and Debt;

- July 17: The Right Care at the Right Time: Leveraging Innovation to Improve Health Care Quality for All;

- July 31: Health Benefits in the Tax Code: The Right Incentives;

- Sept. 9: Improving Health Care Quality: An Integral Step toward Health Reform;

- Sept. 16: Aligning Incentives: The Case for Delivery System Reform;

- Sept. 23: Covering the Uninsured: Making Health Insurance Markets Work;

- Oct. 21: High Health Care Costs: A State Perspective;

- Nov. 19: Health Care Reform: An Economic Perspective

June 16, 2008: “Prepare for Launch: Health Reform Summit 2008” is led by Senate Finance Committee Chairman Max Baucus (D-MT) and Ranking Member Chuck Grassley (R-IA).US Senate Committee on Finance website, accessed 6/21/2017

Jan. 6, 2009: Rep. Jeff Fortenberry (R-NE-1st District) introduces “H.R. 109 – America’s Affordable Health Care Act of 2009,” “To provide for the offering of Health Benefit Plans to individuals, to increase funding for State high risk health insurance pools, and to promote best practice protocols for State high risk pools.” “There have been no roll call votes related to this bill,” according to GovTrack.us as of July 9, 2017.

The ACA’s Negotiation Process and Timeline

On Jan. 20, 2009, Barack Obama took the Oath of Office as the 44th President of the United States.

The 427 days it took President Obama to pass the ACA, also known as Obamacare, starting with President Obama’s inaugural address on Jan. 20, 2009, and ending when he signed the ACA into law on March 23, 2010.

Jan. 20, 2009: President Barack Obama, in his inaugural address, says, among other issues:

“Our health care is too costly. … We will restore science to its rightful place and wield technology’s wonders to raise health care’s quality.”“Barack Obama’s Inaugural Address,” NYTimes.com, 1/20/2009

Jan. 26, 2009: Rep. Conyers, John, Jr. (D-MI) introduces H.R.676 – Expanded and Improved Medicare for All Act, “To provide for comprehensive health insurance coverage for all United States residents, improved health care delivery, and for other purposes.” “There have been no roll call votes related to this bill,” according to GovTrack.us as of July 9, 2017.

Feb. 4, 2009: Rep. Kay Granger (R-TX) introduces H.R. 879 – Affordable Health Care Expansion Act of 2009, “To amend the Internal Revenue Code of 1986 to allow individuals a refundable credit against income tax for the purchase of private health insurance.” “There have been no roll call votes related to this bill,” according to GovTrack.us as of July 9, 2017.

Feb. 5, 2009: On Jan 18, 2007, Sen. Ron Wyden (D-OR) sponsors, and Sen. Chuck Grassley (R-IA) co-sponsors S. 334 – Healthy Americans Act, “A bill to provide affordable, guaranteed private health coverage that will make Americans healthier and can never be taken away,” but it doesn’t go anywhereGovTrack.us, accessed 7/19/2017 and is reintroduced as the 168-page S. 391 – Healthy Americans Act on Feb. 5, 2009, a bipartisan effort that is sent to the Senate Committee on Finance but received no roll call votes on it as of July 12, 2017.

Feb. 10, 2009: Rep. Marcy Kaptur (R-OH) introduces H.R. 956 – Health Coverage, Affordability, Responsibility, and Equity Act of 2009, “To expand the number of individuals and families with health insurance coverage, and for other purposes.” “There have been no roll call votes related to this bill,” according to GovTrack.us as of July 9, 2017.

Feb. 13, 2009: Sen. Byron Dorgan (D-ND) introduces S. 442 – Health Insurance Coverage Protection Act, and Rep. Anna Eshoo (D-CA) introduces H.R. 1085 – Health Insurance Coverage Protection Act, both are “To impose a limitation on lifetime aggregate limits imposed by health plans.” There had been no roll call votes related to either of these bills, according to GovTrack.us, as of July 9, 2017.

Feb. 13, 2009: Rep. Phil Gingrey (R-GA) introduces H.R. 1086 – Help Efficient, Accessible, Low-cost, Timely Healthcare (HEALTH) Act of 2009, “To improve patient access to health care services and provide improved medical care by reducing the excessive burden the liability system places on the health care delivery system.” “There have been no roll call votes related to this bill,” according to GovTrack.us as of July 9, 2017.

Feb. 24, 2009: In his Address Before a Joint Session of Congress, President Obama speaks about the need for health care reform:

“Once again, it will be hard. But I also know that nearly a century after Teddy Roosevelt first called for reform, the cost of our health care has weighed down our economy and our conscience long enough. So let there be no doubt: Health care reform cannot wait, it must not wait, and it will not wait another year.”“February 24, 2009: Address Before a Joint Session of Congress,” MillerCenter.org, accessed 7/8/2009

Feb. 25, 2009: The bipartisan Senate Committee on Finance meets with the CBO for a hearing on “Scoring Health Reform: CBO Budget Options.”

Feb. 25, 2009: Rep. Jim McDermott (D-WA) introduces H.R. 1200 – American Health Security Act of 2009, “To provide for health care for every American and to control the cost and enhance the quality of the health care system.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

March 5, 2009: Obama holds a White House Health Care Summit Opening, the opening of which is covered on C-SPAN. On the same day, he has a “White House Forum on Health Reform Attendees and Breakout Session Participants.” Among the participants are Senators, both Republican and Democrat, and Billy Tauzin, President and CEO of Pharmaceutical Research and Manufacturers of America (PhRMA).“White House Forum on Health Reform Attendees and Breakout Session Participants,” ObamaWhiteHouse.archives.gov, March 5, 2009

March 5, 2009: Rep. Anna Eshoo (D-CA) introduces H.R. 1321 – Healthy Americans Act, “To provide affordable, guaranteed private health coverage that will make Americans healthier and can never be taken away.” It was not enacted as of July 16, 2017, according to GovTrack.us.

March 12, 2009: Senate Finance Committee holds a bipartisan hearing, “Workforce Issues In Health Care Reform: Assessing The Present And Preparing For The Future.”

March 12, 2009: Rep. Ron Paul (R-TX) introduces H.R. 1495 – Comprehensive Health Care Reform Act of 2009, “To amend the Internal Revenue Code of 1986 to make health care coverage more accessible and affordable.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 16, 2017.

March 17, 2009: Sen. John D. Rockefeller, IV (D-WV) introduces S. 623 – Pre-existing Condition Patient Protection Act of 2009, “A bill to amend title I of the Employee Retirement Income Security Act of 1974, title XXVII of the Public Service Act, and the Internal Revenue Code of 1986 to prohibit preexisting condition exclusions in group health plans and in health insurance coverage in the group and individual markets.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

March 25, 2009: Senate Committee on Finance Subcommittee on Health Care holds a bipartisan hearing, “The Role of Long-Term Care in Health Reform.”

March 25, 2009: Sen. Bernie Sanders (I-VT) introduces S. 703 – American Health Security Act of 2009, “A bill to provide for health care for every American and to control the cost and enhance the quality of the health care system.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

March 26, 2009: Rep. Tim Murphy (R-PA) introduces H.R. 1745 – Family Health Care Accessibility Act of 2010, “To amend the Public Health Service Act to provide liability protections for volunteer practitioners at health centers under section 330 of such Act.”Congress.gov, accessed 7/19/2017

H.R. 1745 was voted on in the House Sept. 23, 2010. It passed 417 to 1, with 14 not voting. Voting for the bill were 247 Democrats and 170 Republicans, one Republican against the bill, and seven Democrats and seven Republicans not voting.Congress.gov, accessed 7/19/2017 There are no other actions after it was “Received in the Senate and Read twice and referred to the Committee on Health, Education, Labor, and Pensions,” according to Congress.gov as of July 9, 2017.

April 21, 2009: Senate Committee on Finance holds a bipartisan hearing, “Roundtable to Discuss Reforming America’s Health Care Delivery System.”“Roundtable to Discuss Reforming America’s Health Care Delivery System,” Finance.senate.gov, April 21, 2009

May 4, 2009: Sen. John D. Rockefeller (D-WV) introduces S. 966 – National Health Care Quality Act, “A bill to improve the Federal infrastructure for health care quality improvement in the United States.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

May 5, 2009: Rep. Diana DeGette (D-CO) introduces H.R. 2252 – National Health Care Quality Act, “To improve the Federal infrastructure for health care quality improvement in the United States.” It was referred to several Committees, but was not passed, according to Congress.gov, as of July 9, 2017.

May 5, 2009: Senate Committee on Finance holds a bipartisan hearing, “Roundtable Discussion on Expanding Health Care Coverage.”

May 11, 2009: President Obama and administration officials meet with “health care reform stakeholders” at the White House “concerning reducing the growth rate of health care costs.”“Today’s Health Care Costs Meeting-Participants, Fact Sheet, and Letter,” ObamaWhiteHouse.archives.gov, May 11, 2009 Among the participants are insurers, hospitals, physicians, medical device companies, and Billy Tauzin, President and CEO of PhRMA.

May 12, 2009: Senate Committee on Finance holds a bipartisan hearing, “Roundtable Discussion on Financing Comprehensive Health Care Reform.”

May 21, 2009: Sen. Rockefeller, John D., IV (D-WV) introduces S. 1149 – Annual and Lifetime Health Care Limit Elimination Act of 2009, “A bill to eliminate annual and lifetime aggregate limits imposed by health plans.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

June 2, 2009: Rep. Christopher Murphy (D-CT) introduces H.R. 2668 – Choice in Health Options Insures Care for Everyone (CHOICE) Act of 2009, “To provide for the offering of an American Trust Health Plan to provide choice in health insurance options so as to ensure quality, affordable health coverage for all Americans.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

June 9, 2009: S.1679 – Affordable Health Choices Act is introduced to the Senate by Sen. Tom Harkin (D-IA) on June 9, 2009, and passed by the Senate HELP [Health, Education, Labor and Pension] Committee on July 15, 2009, 13 to 10.NYTimes.com, “Senate Committee Approves Health Care Bill,” TheCaucus.blogs, July 15, 2009 An estimated 500 amendments were made to the bill in “markup” (the process of amending proposed legislation) between June 17 and July 14, 2009. It was then reported on September 17, 2009.John Cannan, “A Legislative History of the Affordable Care Act: How Legislative Procedure Shapes Legislative History,” Stanford / Law Library Journal, Vol. 105, 2013-17 Sen. Ted Kennedy was also part of this effort.“Kennedy, HELP Committee Democrats Announce the ‘Affordable Health Choices Act’ Bipartisan Talks Continue on Outstanding Key Issues,” Senate HELP Committee, June 9, 2009 He passes away Aug. 25, 2009.

June 11, 2009: During a Town Hall on Health Care in Green Bay, Wisconsin, President Obama said:

“In all these reforms, our goal is simple: the highest quality health care at the lowest-possible cost. Let me repeat what I said before: We want to fix what’s broken, build on what works. As Congress moves forward on health care legislation in the coming weeks there are going to be different ideas and disagreements about how to achieve this goal. And I welcome all ideas; we’ve got to have a good debate. What I will not welcome, what I will not accept is endless delay or a denial that reform needs to happen.”Transcript, “Remarks by the President in Town Hall Meeting on Health Care in Green Bay, Wisconsin,” ObamaWhiteHouse.archives.gov, June 11, 2009

June 15, 2009: Sen. Jon Kyl (R-AZ) introduces S. 1259 – PATIENTS Act of 2009, “A bill to protect all patients by prohibiting the use of data obtained from comparative effectiveness research to deny coverage of items or services under Federal health care programs and to ensure that comparative effectiveness research accounts for advancements in personalized medicine and differences in patient treatment response.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

June 17, 2009: Sen. John D. Rockefeller, IV (D-WV) introduces S. 1278 – Consumers Health Care Act of 2009, “A bill to establish the Consumers Choice Health Plan, a public health insurance plan that provides an affordable and accountable health insurance option for consumers.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

June 17 – September 14, 2009: The “Gang of Six,” a group of Senators from the Senate Finance Committee composed of three Democrats (Max Baucus [MT], Jeff Bingaman [NM], and Kent Conrad [ND]) and three Republicans (Mike Enzi [WY], Chuck Grassley [IA], and Olympia Snowe [ME]), begin work on health care reform.Alexander Bolton, “Gang of Six Healthcare Reform Negotiations on Verge of Collapse,” TheHill.com, Sept. 4, 2009

There are 31 bipartisan “Gang of Six” meetings in 2009:US Senate Committee on Finance website, accessed 7/12/2017

| 1. June 17 | 8. July 9 | 14. July 23 | 20. August 3 | 26. September 4 |

| 2. June 18 | 9. July 15 | 15. July 27 | 21. August 4 | 27. September 8 |

| 3. June 23 | 10. July 16 | 16. July 28 | 22. August 5 | 28. September 9 |

| 4. June 24 | 11. July 20 | 17. July 29 | 23. August 6 | 29. September 10 |

| 5. June 25 | 12. July 21 | 18. July 30 | 24. August 6 | 30. September 11 |

| 6. July 7 | 13. July 22 | 19. July 30 | 25. August 20 | 31. September 14 |

| 7. July 8 |

June 20, 2009: Obama releases a statement on an “Agreement to Bring Down Drug Prices for America’s Seniors”:

“I am pleased to announce that an agreement has been reached between Senator Max Baucus and the nation’s pharmaceutical companies that will bring down health care costs and reduce the price of prescription drugs for millions of America’s seniors… The agreement reached today to lower prescription drug costs for seniors will be an important part of the legislation I expect to sign into law in October. I want to commend House chairmen Henry Waxman, George Miller and Charles Rangel for addressing this issue in the health reform legislation they unveiled this week.”“Statement from President Obama on Agreement to Bring Down Drug Prices for America’s Seniors,” ObamaWhiteHouse.archives.gov, June 20, 2009

June 23, 2009: Sen. Jim Demint (R-SC) introduces S. 1324 –Health Care Freedom Act of 2009, “A bill to ensure that every American has a health insurance plan that they can afford, own, and keep.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

June 23, 2009: Rep. John Boehner (R-OH) introduces H.R. 3002 – PATIENTS Act of 2009, “To protect all patients by prohibiting the use of data obtained from comparative effectiveness research to deny coverage of items or services under Federal health care programs and to ensure that comparative effectiveness research accounts for advancements in personalized medicine and differences in patient treatment response.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 16, 2017.

June 26, 2009: Rep. Tom Latham (R-IA) introduces H.R. 3067 – Health Security for All Americans Act of 2009, “To amend title XVIII of the Social Security Act to reform Medicare payments to physicians and certain other providers and improve Medicare benefits, to encourage the offering of health coverage by small businesses, to provide tax incentives for the purchase of health insurance by individuals, to increase access to health care for veterans, to address the nursing shortage, and for other purposes.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

July 7, 2009: The Obama White House sends out a press release from the president on health care reform:

“I am pleased by the progress we’re making on health care reform and still believe, as I’ve said before, that one of the best ways to bring down costs, provide more choices, and assure quality is a public option that will force the insurance companies to compete and keep them honest. I look forward to a final product that achieves these very important goals.”“Statement from the President on Health Care Reform,” ObamaWhiteHouse.archives.gov, July 7, 2009

July 14, 2009: Rep. John Shadegg (R-AZ) introduces H.R. 3217 – Health Care Choice Act of 2009, “To amend the Public Health Service Act to provide for cooperative governing of individual health insurance coverage offered in interstate commerce.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

July 14, 2009: H.R. 3200, one of the first major health care reform bills, is introduced by Rep. John Dingell (D-MI) and submitted to several committees from July to October of 2009.Congress.gov, accessed 7/12/2017

July 16, 2009: Sen. Jim DeMint (R-SC) introduces S. 1459 –Health Care Choice Act of 2009, “A bill to amend the Public Health Service Act to provide for cooperative governing of individual health insurance coverage offered in interstate commerce.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

July 29, 2009: President Obama attends a Town Hall on health care reform at Broughton High School in Raleigh, North Carolina.

Aug. 11, 2009: President Obama attends a Town Hall on health care reform in New Hampshire, where he says:

“And my hope is we can do it in a bipartisan fashion, but the most important thing is getting it done for the American people.”“Obama’s Health Care Town Hall in Portsmouth,” NYTimes.com, Aug. 11, 2009

Aug. 14, 2009: President Obama, Sen. Max Baucus (D-MT), Sen. Jon Tester (D-MT), and Gov. Brian Schweitzer discuss health care reform at a Town Hall in Montana.“Background on the President’s Town Hall in Montana Today: Health Insurance Reform Town Hall,” ObamaWhiteHouse.archives.gov, Aug. 14, 2009

Aug. 15, 2009: President Obama attends a Colorado Town Hall on health care reform.“Obama Gets Personal in Health Care Town Hall Meeting,” CNN.com, Aug. 15, 2009

Aug. 20, 2009: A Town Hall with Sen. Lisa Murkowski (R-AK) is shown on C-SPAN where she mentions the “four weeks going through all aspects of the bill” but that the bipartisan committee was pressured to get it out immediately.

Aug. 24, 2009: “Rep. Jim Marshall (D-GA) held his second Town Hall meeting on health care in Warner Robins, Georgia, on August 24th. The papers reported that over 1,000 people attended. … Marshall added that he hadn’t read H.R. 3200 because he knew it didn’t meet his criteria for health care reform and therefore he wasn’t going waste his time.”Terry Humphrey, “Dem Rep. Marshall: I Haven’t Read the Health Care Bill, But I Won’t Vote For It.,” HuffPost.com, Sept. 27, 2009

Sept. 9, 2009: Obama addresses joint session on Congress, where Republican Rep. Joe Wilson (R-SC) yells out “You lie,” on his plan for health care reform, and health care reform past and present:

“I am not the first President to take up this cause, but I am determined to be the last. It has now been nearly a century since Theodore Roosevelt first called for health care reform. And ever since, nearly every President and Congress, whether Democrat or Republican, has attempted to meet this challenge in some way. A bill for comprehensive health reform was first introduced by John Dingell Sr. in 1943. Sixty-five years later, his son continues to introduce that same bill at the beginning of each session.”“Transcript: Obama’s Health Care Speech,” CBSNews.com, Sept. 9, 2009“Healthcare Timeline,” ObamaWhiteHouse.archives, accessed 7/8/2017

Sept. 17, 2009: H.R. 3590 is introduced in House. This version would go on to be debated, amended, passed and made into law as the ACA (Obamacare) on March 23, 2010.

Sept. 17, 2009: Sen. Thomas Harkin (D-IA) introduces, S. 1679 – Affordable Health Choices Act, “An original bill to make quality, affordable health care available to all Americans, reduce costs, improve health care quality, enhance disease prevention, and strengthen the health care workforce.” There had been no roll call votes related to this bill, according to GovTrack.us, as of July 9, 2017.

Oct. 8, 2009: The bill H.R. 3590, titled Service Members Home Ownership Tax Act, is passed in House 416 [243 Democrats and 173 Republicans] to 0 with 16 No Votes [12 Democrats and 4 Republicans].Clerk.House.gov, accessed 7/9/2017 There were two vacancies, and as House Speaker, Nancy Pelosi did not vote.US House of Representatives Library, Office of the Clerk email response 7/14/2017

Oct. 13, 2009: A measure based on S. 1796 – America’s Healthy Future Act of 2009 is introduced in the Senate Committee on Finance on September 16, 2009, and discussed and amended during 8 bipartisan hearings starting September 22 (Sept. 22, Sept. 23, Sept. 24, Sept. 25, Sept. 29, Sept. 30, Oct. 1, Oct. 13)“Results of Executive Action: America’s Healthy Future Act of 2009,” PDF from Finance.Senate.gov, accessed 7/26/2017 https://www.finance.senate.gov/imo/media/doc/101309.pdf to when it passed on Oct. 13, 2009.

On the last day of meetings on Oct. 13, 2009, Chairman Sen. Max Baucus (D-MT) said:

“It has been more than 22 years since the Finance Committee met for 8 days on a single bill. Senators offered, and the committee considered, 135 amendments… conducted 79 roll call votes… adopted 41 amendments.”“Executive Business Meeting to Consider an Original Bill Providing for Health Care Reform,” Finance.Senate.gov, accessed 7/26/2017

The vote on the measure was 14-9; Sen. Olympia Snowe (R-ME) was the only Republican voting for the measure along with 13 Democrats, and nine Republicans voted against.Health Care Reform and American Politics: What Everyone Needs to Know, Google book accessed 6/18/2017 and Homeland Security Digital Library, accessed 7/19/2017 It was posted for review before the final committee vote, according to the Senate Committee on Finance website.

Oct. 19, 2009: The bill S.1796 – America’s Healthy Future Act of 2009 is introduced by Sen. Max Baucus (D-MT) on Oct. 19, 2009. Although there are no roll call votes on this bill, “S. 1796 later became an amendment to H.R. 3590, and floor debate began on November 21 with final Senate passage on December 24, 2009.”Footnote 23 to “Congress, Interest Groups, and the Strategic Use of Judicial Review,” by Gary S. Pascoa, Rhode Island College, Honors Project, Digital Commons, April 17, 2014

Oct. 29, 2009: Affordable Health Care for America Act (H.R. 3962), also titled H.R.3962 – Preservation of Access to Care for Medicare Beneficiaries and Pension Relief Act of 2010 on Congress.gov, is passed by the House 220 to 215 on Nov. 7, 2009. Voting for the bill were 219 Democrats and one Republican, with 39 Democrats and 176 Republicans voting against it.“House Passes Health Care Reform Bill,” CNN.com, Nov. 8. 2009 It was then sent to the Senate for a vote. Congresswoman Nancy Pelosi introduced the Rep. John Dingell (D-MI-15th District)- sponsored bill on Oct. 29, 2009, which combined earlier versions by the Committees that worked on H.R. 3200, according to GOP.gov. This eventually became Public Law 111-192 on June 25, 2010.

Nov. 3, 2009: A Manager’s Amendment is filed for H.R. 3962 – Affordable Health Care for America Act to add “key improvements” to the bill H.R. 3962.“Pelosi Statement on Manager’s Amendment to the Affordable Health Care for America Act,” Pelosi.House.gov, Nov. 3, 2009

Nov. 18, 2009: Sen. Harry Reid (D-NV) releases the product of merged Committee health care reform negotiations on previous bills as H.R. 3590 – Patient Protection and Affordable Care Act.

Dec. 8, 2009: The Senate rejects the bipartisan Nelson-Hatch Amendment to the Patient Protection and Affordable Care Act, by Sen. Orrin Hatch (R-UT) and Sen. Ben Nelson (D-NE), 54 [51 Democrats, two Republicans, one Independent] to 45 [38 Democrats, 7 Republicans] proposed to prohibit “funding of abortion by the government insurance program, and prohibited federal subsidies for private plans that cover abortion (with exceptions for abortion in cases of rape, incest, or to save the life of the mother).”“U.S. Senate Rejects NRLC-Backed Nelson-Hatch Amendment, 54 to 45,” NRLC.org, Vol 36, Nov/Dec 2009

Dec. 24, 2009: H.R. 3590, the Patient Protection and Affordable Care Act, is passed 60 to 39 by the Senate [59 Democrats and one Independent voted for the bill, 39 Republicans voted against the bill, with Republican Jim Bunning [R-KY] not voting.“Roll Call Vote 111th Congress – 1st Session.” Senate.gov, accessed 7/16/2017

December 30, 2009: The nonpartisan media company C-SPAN sends a letter to Congress formally requesting that they open the health care negotiations to the media:

“C-SPAN’s open call for full transparency is a highly unusual move for a media organization that steadfastly refuses to take sides, demonstrating how far Democrats have gone in cloaking the healthcare bill with more secrecy than even the Washington Wizards locker room.”Doug Heye, “C-SPAN Demands Democrats Open Secret Health Reform Talks,” usnews.com, January 5, 2010

Jan 19, 2010: Scott Brown (R) is elected to replace the late Sen. Ted Kennedy (D) from Massachusetts,Michael Cooper, “G.O.P. Senate Victory Stuns Democrats,” NYTimes.com, Jan. 19, 2010 which shifts the balance of power on the health care reform vote in the Senate.

Jan. 29, 2010: In response to comments that not all ACA discussions were shown on C-SPAN, President Obama said on C-SPAN at a House Republican Conference:

“[T]he truth of the matter is that if you look at the health care process – just over the course of the year – overwhelmingly the majority of it actually was on C-SPAN… And I take responsibility for not having structured it in a way where it was all taking place in one place that could be filmed. How to do that logistically would not have been as easy as it sounds, because you’re shuttling back and forth between the House, the Senate, different offices, et cetera, different legislators. But I think it’s a legitimate criticism. So on that one, I take responsibility.”“Remarks by the President at GOP House Issues Conference,” Obama White House Archives, Jan. 29, 2010

Feb. 10, 2010: President Obama and Republicans meet for a two-hour negotiation session on many issues including health care.Washington Post staff, “Obama Engages Republicans, Appeals for Bipartisanship,” Boston.com, Feb. 10, 2010

Feb. 22, 2010: Obama outlines a health care plan which “attempts to bridge the difference between House and Senate bills.”John Wojcik, “Obama Rolls Out Health Care Plan, Moves to Block Rate Hikes,” PeoplesWorld.org, Feb. 22, 2010

Feb. 25, 2010: President Obama holds a bipartisan health care summit and presents his health care reform bill:

“By day’s end, it seemed clear that the all-day televised session might have driven the parties even farther apart. Republicans said there was no way they would vote for Mr. Obama’s bill, and Democrats were talking openly about pushing it through Congress on a simple majority vote using a controversial parliamentary maneuver known as reconciliation.”By Sheryl Gay Stolberg and Robert Pear, “President Urges Focus on Common Ground,” NYTimes.com, Feb. 25, 2010

Some Republican members in attendance at the Feb. 25, 2010, summit were Rep. Joe Barton (R-TX-6th District), Sen. Tom Coburn (R-OK) and Sen. Mitch McConnell (R- KY).

In its article on the summit, CNN.com quotes Obama as saying:

“Politically speaking, there may not be any reason for Republicans to want to do anything … But, I thought it was worthwhile for us to make this effort.”“Highlights from Obama’s Health Care Summit,” CNN.com, Feb. 25, 2010

March 9, 2010: House Speaker Nancy Pelosi [D-CA-12th District] speaks at the 2010 Legislative Conference for the National Association of Counties:

“You’ve heard about the controversies within the bill, the process about the bill, one or the other. But I don’t know if you have heard that it is legislation for the future, not just about health care for America, but about a healthier America, where preventive care is not something that you have to pay a deductible for or out of pocket. Prevention, prevention, prevention–it’s about diet, not diabetes. It’s going to be very, very exciting. But we have to pass the bill so that you can find out what is in it, away from the fog of the controversy.”Press Release, “Pelosi Remarks at the 2010 Legislative Conference for National Association of Counties,” DemocraticLeader.gov, March 9, 2010

March 18, 2010: The preliminary estimate from the CBO is presented to Speaker Nancy Pelosi. In Table 2. under “Effects on Insurance Coverage,” the chart shows the “Post-Policy Uninsured Population” of the nonelderly going from 50 million in 2010 to 23 million in 2019.CBO.gov, accessed 7-9-2017

March 19, 2010: The final ACA bill is available for review the Friday before the Sunday vote.Geoff Earle, “Dems Draw Up Final Health Bill, Set for Vote Sunday,” NYPost.com, March 19, 2010

March 21, 2010: On Sunday, March 21, 2010, the final House vote was 219 to 212 to approve H.R. 3590, “with every Republican voting no.”Shailagh Murray and Lori Montgomery, “Senate Passes Health-Care Bill, Now Must Reconcile It with House,” WashingtonPost.com, Dec. 25, 2009 The final vote of the 435 representatives was 219 Democrats voting for the bill, and 34 Democrats and 178 Republicans voting against the bill. There were four vacancies at the time.GovTrack.us, accessed 7/9/2017

March 23, 2010: H.R. 3590 is signed by President Obama and becomes Public Law No. 111-148. The final law’s page length is 906.Congress.gov, accessed 7/16/2017

Health Care Reform Bills that Evolved Into the Final ACA

During the time up to the ACA (Obamacare) passage, several health care reform bills were introduced. Few made it through the Committee process. Versions changed as they passed from Committees and were voted on by the House and Senate.

H.R. 3590, a merger of the major Senate bills, was the one to go on for the final vote in 2010, and became ACA (Obamacare).

The following is information on each of the major bills that contributed in some part to the final ACA bill on its path to become law:

1. H.R. 3200: This bill was introduced on July 14, 2009. On August 2009:

“’I had people come to my town meeting with sheets of paper that thick off the Internet and quoting from the bill,’ Sen. Grassley [R-IA] tells FRONTLINE ‘I’ve never had that happen before. People were up on it, and people didn’t like what they were reading.’ ”“Obama’s Deal,” PBS.org, April 13, 2010

- Page length: 1,017 pages, introduced in House 7/14/2009;https://www.congress.gov/111/bills/hr3200/BILLS-111hr3200ih.pdf 2,452 pages as Reported in House 10/14/2009.https://www.congress.gov/111/bills/hr3200/BILLS-111hr3200rh.pdf “This phrase accompanies a committee’s report of its findings and recommendations to the parent house after it has examined a bill. The version of the bill as reported includes changes, if any, that have been recommended by the committee.” PotomacPublishing.com, accessed 7/9/2017

- Length of time available before vote: There was never a vote on the bill

- Representatives listed on the bill – all Democrats: Mr. DINGELL (for himself, Mr. RANGEL, Mr. WAXMAN, Mr. GEORGE MILLER of California, Mr. STARK, Mr. PALLONE, and Mr. ANDREWS) introduced the following bill; which was referred to the Committee on Energy and Commerce, and in addition to the Committees on Ways and Means, Education and Labor, Oversight and Government Reform, and the Budget, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned

2. S.1679: Sen. Chuck Grassley [R-IA] remarked on the bill:

“Let’s start with the HELP Committee bill. On September 17th, the HELP Committee finally released its 839-page health care bill, over two months after the Democrats on the HELP committee voted to report it. When I was back in Iowa for the August recess, I held 17 town meetings. Due to the controversial health care bill that the HELP Committee and the three House committees had just voted on, the attendance was the highest I’ve seen in the 2,871 town halls I’ve held during my 29 years of service in the Senate. Many of the people who attended were citing sections from the health reform bills. They had good questions. I heard repeatedly about the new powers being granted to the government in these bills.

So I decided that we should have a catalog of how many times these bills grant new powers to the Secretary of Health and Human Services. Well, I have the HELP Committee bill here with me today and there’s a lot going on in the 839 pages of this bill.”“Grassley Floor Statement on the Government Takeover Contained in the HELP and House Health Care Bills,” U.S. Senate Committee on Finance website, Nov. 2, 2009

- Page length: 839https://www.congress.gov/111/bills/s1679/BILLS-111s1679pcs.pdf – Introduced Sept. 17, 2009

- Length of time available before vote: There was never a vote on the bill introduced Sept. 17, 2009

- Representatives listed on the bill – a Democrat: Mr. HARKIN, from the Committee on Health, Education, Labor, and Pensions

3. H.R. 3590 – Introduced in House Sept. 17, 2009, by Rep. Charles Rangel (D-NY-15th District), it passes the House on Oct. 10, 2009, and the Senate voted on it Dec. 24, 2009. The bill eventually became law on March 23, 2010.

“The measure went to committee (Ways and Means, then chaired by Rep. [sic] Rengel) and then to the floor of the House where it was debated on October 7, 2009 and eventually passed with a vote of 243-173 …”Kelly Phillips Erb, “If The Health Care Law Is Really A Tax Law, Is It Doomed on Procedure?,” Forbes.com, June 29, 2012

- Page lengths:

- 6 pageshttps://www.congress.gov/111/bills/hr3590/BILLS-111hr3590ih.pdf as Introduced on 9/17/2009

- 6 pageshttps://www.congress.gov/111/bills/hr3590/BILLS-111hr3590eh.pdf – Engrossed in House version

- 6 pageshttps://www.congress.gov/111/bills/hr3590/BILLS-111hr3590pcs.pdf when Placed on Calendar Senate on 10/13/2009

- 2,074 pageshttps://www.congress.gov/111/bills/hr3590/BILLS-111hr3590as.pdf as Amend. Ordered Printed (Senate) 11/19/2009

- 2,407 pageshttps://www.congress.gov/111/bills/hr3590/BILLS-111hr3590eas.pdf for the Engrossed Amendment Senate version on 12/24/2009

- 2,407 pageshttps://www.congress.gov/111/bills/hr3590/BILLS-111hr3590pp.pdf for the Public print of 12/24/2009

- 906 pageshttps://www.congress.gov/111/bills/hr3590/BILLS-111hr3590enr.pdf for the Enrolled bill on 1/5/2010

- Final Law’s Page Length: 906 pageshttps://www.congress.gov/111/plaws/publ148/PLAW-111publ148.pdf – Public Law 111-148

- Length of time available before the final vote: March 19, 2010,Geoff Earle, “Dems Draw Up Final Health Bill, Set for Vote Sunday,” NYPost.com, March 19, 2010 to the vote on March 21, 2010

- Representatives listed on the bill Sept. 17, 2009 – Bipartisan: Mr. RANGEL (for himself, Mr. SKELTON, Mr. BLUMENAUER, Mr. KIND, Mr. JONES, Mr. KAGEN, Mr. STARK, Mr. LEVIN, Mr. MCDERMOTT, Mr. LEWIS of Georgia, Mr. NEAL of Massachusetts, Mr. TANNER, Mr. BECERRA, Mr. DOGGETT, Mr. POMEROY, Mr. THOMPSON of California, Mr. LARSON of Connecticut, Mr. PASCRELL, Ms. BERKLEY, Mr. CROW- LEY, Mr. MEEK of Florida, Mr. VAN HOLLEN, Ms. SCHWARTZ, Mr. DAVIS of Alabama, Mr. DAVIS of Illinois, Mr. ETHERIDGE, Ms. LINDA T. SA ́NCHEZ of California, Mr. HIGGINS, Mr. YARMUTH, and Ms. GINNY BROWN-WAITE of Florida) introduced the following bill; which was referred to the Committee on Ways and Means

4. S. 1796: Was “Ordered to be printed” on Oct. 19, 2009

- Page length: 1,502 pageshttps://www.congress.gov/111/bills/s1796/BILLS-111s1796pcs.pdf as Introduced Oct. 19, 2009

- Length of time available before vote: There was no vote on this bill “Ordered to be printed” on Oct. 19, 2009

- Representatives listed on the bill – a Democrat: Mr. BAUCUS, (D) from the [Senate] Committee on Finance

5. H.R. 3962: A NationalReview.com reporter got a copy of this bill on Oct. 29, 2009, before the Nov. 7, 2009, vote:

“I’m starting to read the health bill Speaker Pelosi unveiled at a pep rally this morning. I feel like I’m back in college. I’ve got something to read. I will read it not because it is interesting, but because reading it will make me a better educated person. It is long. It is very long. It is 1,990 pages long.”

- Page length: 1,990 pageshttp://housedocs.house.gov/rules/health/111_ahcaa.pdf as Introduced Oct. 29, 2009

- Length of time available before vote: Oct. 29, 2009, to Nov. 7, 2009

- Representatives listed on the bill – all Democrats: Mr. DINGELL (for himself, Mr. RANGEL, Mr. WAXMAN, Mr. GEORGE MILLER of California, Mr. STARK, Mr. PALLONE, and Mr. ANDREWS) introduced the following bill; which was referred to the Committee on Energy and Commerce, and in addition to the Committees on Education and Labor, Ways and Means, Oversight and Government Reform, the Budget, Rules, Natural Resources, and the Judiciary, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned

The Final Version of the ACA Bill

H.R. 3590, which became the ACA (Obamacare), was originally introduced on September 17, 2009, according to Congress.gov:Congress.gov, accessed 6/19/2017

“An Act to amend the Internal Revenue Code of 1986 to modify the first-time homebuyers credit in the case of members of the Armed Forces and certain other Federal employees, and for other purposes.”

The “short title” is Patient Protection and Affordable Care Act, which became Public Law No: 111-148, and is introduced by Rep. Charles B. Rangel (D-NY) September 17, 2009, by the House Ways and Means Committee.

The bill H.R. 3590, titled Service Members Home Ownership Tax Act, is passed in House 416 [243 Democrats and 173 Republicans] to 0 with 16 No Votes [12 Democrats and four Republicans] on October 8, 2009. There were two vacancies, and as House Speaker, Nancy Pelosi did not vote.U.S. House of Representatives Library | Office of the Clerk email response 7/14/2017

The Senate version of the Patient Protection and Affordable Care Act, which was voted on and passed December 24, 2009, was created from several other bills and Committee negotiations on bills being merged:

“Senate Majority Leader Harry Reid (D-NV) last night unveiled the ‘Patient Protection and Affordable Care Act’ (H.R. 3590), which merges health reform bills approved by the Senate Finance and Health, Education, Labor & Pensions committees.”“Reid Releases Merged Senate Health Reform Bill,” News.AHA.org, Nov. 19, 2009

There are seven text versions of H.R. 3590 on Congress.gov before it became Public Law 111-148 on March 23, 2010. The Senate Dec. 24, 2009, vote on H.R. 3590:

“The Senate bill passed without a single GOP vote, after a 25-day floor debate marked by biting partisan rhetoric. As Democrats overcame divisions and closed ranks, accepting concessions to push the bill through, Republicans became fierce in opposition. Even Sen. Olympia J. Snowe (R-Maine) – a moderate courted over many months by Obama – responded ‘No,’ frowning when the Senate clerk called her name.”Shailagh Murray and Lori Montgomery, “Senate Passes Health-Care Bill, Now Must Reconcile It with House,” WashingtonPost.com, Dec. 25, 2009

Congress.gov records 209 Actions, from Amendment votes to the final vote, for H.R. 3590, including 34 Senate and 2 House roll call votes from Oct. 8, 2009, to when it was passed by the House on March 21, 2010.

The Senate’s first vote on H.R. 3590 was Nov. 21, 2009, to continue debate on the bill, then it was passed on for House consideration on Dec. 24, 2009.

The March 18, 2010, CBO report came out three days before the vote on March 21, 2010:

“On March 18, 2010 — three days before the final ACA vote in the House — the official Twitter account of the House GOP asked, ‘Will Speaker Pelosi *Wait for the Final Number* from the CBO?’ The [CBO] score was released that day.”Nathaniel Weixel, “Democrats Turn Tables on GOP in ObamaCare Messaging War,” TheHill.com, May 7, 2017 [March 18, 2010, 3 days before the House vote, and 5 days before the ACA (Obamacare) became law.]

Republicans were still not going to vote for the bill, according to House Minority Leader John Boehner in an article dated March 18, 2010:

“We’re going to continue to work closely together and to do everything that we can do to make sure that this bill never, ever, ever passes.”“Republicans Ready Strategy to Scuttle Health Bill, as Democrats Push Forward,” FoxNews.com, March 18, 2010

On March 21, 2010, the final House vote was 219 to 212 to approve H.R. 3590, “with every Republican voting no.”Shailagh Murray and Lori Montgomery, “Senate Passes Health-Care Bill, Now Must Reconcile It with House,” WashingtonPost.com, Dec. 25, 2009 The final vote of the 435 representatives was 219 Democrats voting for the bill, and 34 Democrats and 178 Republicans voting against the bill. There were 4 vacancies at the time.GovTrack.us, accessed 7/9/2017

On March 23, 2010, Obama signed the 906-page ACA (Obamacare) into law.

Conclusion on the Question

Was the ACA (Obamacare) negotiated by the Democrats in secret and did they keep Republicans out of that negotiation process on purpose?

Here are three conclusions from this report. However, please keep in mind that the 60 discussions are just a small fraction of such discussions as there must have been thousands, if not tens of thousands, of official and unofficial discussions about health care and the ACA during the 427 days it took to pass the ACA (Obamacare) law.If each Congress member discussed President Obama’s health care cause with a non-Congress member one time a day for the 427 days it took to pass the ACA, that would have been 228, 445 (535 x 1 x 427) such discussions.

- The quotes by Sen. Mitch McConnell (R-KY) on Oct. 2, 2009, and current Vice President Mike Pence and Sen. Richard Burr (R-NC) on Jan. 13, 2010, show they wanted the health care negotiations out from behind closed doors, and that the CBOCBO is the acronym for the Congressional Budget Office. “Since 1975, CBO has produced independent analyses of budgetary and economic issues to support the Congressional budget process. Each year, the agency’s economists and budget analysts produce dozens of reports and hundreds of cost estimates for proposed legislation.” CBO.gov, accessed 7/27/2017 scoring of any health care bill was important to Sen. McConnell.

- There were bipartisan discussions about health care reform (interactions with or accessible by Republicans) during those 427 days. The following 60 are just from this report:

- 31 “Gang of Six” Senate Committee on Finance bipartisan discussions from June 17, 2009, to Sept. 14, 2009

- 14 regular Senate Committee on Finance bipartisan meetings from Feb. 25, 2009, to Oct. 13, 2009

- 7 Town Halls from June 11, 2009, to Aug. 24, 2009

- 5 Health care reform votes on bills and measures from Sept. 23, 2009, to March 21, 2010

- 2 White House heath care summits on March 5, 2009, and Feb. 25, 2010

- 1 Health care reform meeting between President Obama and Republicans on Feb. 10, 2010

- It is probably impossible to ascertain the intent of Democrat and Republican actions regarding the ACA process.

For example, did Sen. Mitch McConnell (R-KY) and current Vice President Mike Pence really want negotiations about health care out in the open, or did they actually want to cripple or kill the health care negotiations? When President Obama said various times that if you liked your doctor you can keep your doctor, did he think it was true or that it was substantially true when he said it, or did he say it knowing it wouldn’t be true but he decided to say it to garner public support needed to get the votes for the ACA?

In sum, the 427 days it took to pass the ACA (Obamacare) were fraught with emotional and biased views and vast political differences as to whether such a law would be good for America. The process making the ACA (Obamacare) law was quite political, meaning that things weren’t always as they seemed.

Appendix A: “If You Like Your Doctor”

Much has been made about the fact that during the process to pass the ACA (Obamacare), President Obama said many times that in effect “if you like your doctor” or your health care plan you can “keep” them.

From the President Obama White House archives,ObamaWhiteHouse.archives.gov, accessed 7/9/2017 the search for the words “if you like your doctor” results in 21 times Obama used that phrase from June 11, 2009, to the day he signed the ACA (Obamacare) into law on March 23, 2010. The following is a list of the 21 times that President Obama said the phrase “if you like your doctor” [which has been bolded for brevity], from June 11, 2009, to the day he signed ACA (Obamacare) into law on March 23, 2010, from a speech, address or remark on the President Obama White House website:

1. June 11, 2009: “Remarks by the President in Town Hall Meeting on Health Care in Green Bay, Wisconsin”

“I know that there are millions of Americans who are happy, who are content with their health care coverage – they like their plan, they value their relationship with their doctor. And no matter how we reform health care, I intend to keep this promise: If you like your doctor, you’ll be able to keep your doctor; if you like your health care plan, you’ll be able to keep your health care plan.

So don’t let people scare you. If you like what you’ve got, we’re not going to make you change. But in order to preserve what’s best about our health care system, we have to fix what doesn’t work. For we’ve reached the point where doing nothing about the cost of health care is no longer an option.”

2. June 15, 2009: “Remarks by the President to the Annual Conference of the American Medical Association”

“So let me begin by saying this to you and to the American people: I know that there are millions of Americans who are content with their health care coverage – they like their plan and, most importantly, they value their relationship with their doctor. They trust you. And that means that no matter how we reform health care, we will keep this promise to the American people: If you like your doctor, you will be able to keep your doctor, period. If you like your health care plan, you’ll be able to keep your health care plan, period. No one will take it away, no matter what. My view is that health care reform should be guided by a simple principle: Fix what’s broken and build on what works. And that’s what we intend to do.”

3. July 15, 2009: “Remarks by the President on Health Care Reform”

“I know a lot of Americans who are satisfied with their health care right now are wondering what reform would mean for them, so let me be clear: If you like your doctor or health care provider, you can keep them. If you like your health care plan, you can keep that too.”

4. July 17, 2009: President’s “Weekly Address: President Obama Says Health Care Reform Cannot Wait”

“Those who oppose reform will also tell you that under our plan, you won’t get to choose your doctor – that some bureaucrat will choose for you. That’s also not true. Michelle and I don’t want anyone telling us who our family’s doctor should be – and no one should decide that for you either. Under our proposals, if you like your doctor, you keep your doctor. If you like your current insurance, you keep that insurance. Period, end of story.”

5. July 29, 2009: “Remarks by the President at Town Hall in Raleigh, North Carolina”

“First of all, nobody is talking about some government takeover of health care. I’m tired of hearing that. I have been as clear as I can be. Under the reform I’ve proposed, if you like your doctor, you keep your doctor. If you like your health care plan, you keep your health care plan. These folks need to stop scaring everybody. Nobody is talking about you forcing – to have to change your plans.”

6. Aug. 8, 2009: President’s “Weekly Address: President Obama Calls Health Insurance Reform Key to Stronger Economy and Improvement on Status Quo”

“So, let me explain what reform will mean for you. And let me start by dispelling the outlandish rumors that reform will promote euthanasia, cut Medicaid, or bring about a government takeover of health care. That’s simply not true. This isn’t about putting government in charge of your health insurance; it’s about putting you in charge of your health insurance. Under the reforms we seek, if you like your doctor, you can keep your doctor. If you like your health care plan, you can keep your health care plan.

And while reform is obviously essential for the 46 million Americans who don’t have health insurance, it will also provide more stability and security to the hundreds of millions who do. Right now, we have a system that works well for the insurance industry, but that doesn’t always work well for you. What we need, and what we will have when we pass health insurance reform, are consumer protections to make sure that those who have insurance are treated fairly and that insurance companies are held accountable.”

7. Aug. 11, 2009: “Remarks by the President at Town Hall on Health Insurance Reform in Portsmouth, New Hampshire”

“Now, let me just start by setting the record straight on a few things I’ve been hearing out here – (laughter) – about reform. Under the reform we’re proposing, if you like your doctor, you can keep your doctor. If you like your health care plan, you can keep your health care plan.”

8. Aug. 14, 2009: “Remarks by the President in town hall on health care, Belgrade, Montana”

“Now, if you are one of nearly 46 million people who don’t have health insurance, you’ll finally have quality affordable options. And if you do have health insurance, we’ll help make sure that your insurance is more affordable and more secure. If you like your health care plan, you can keep your health care plan. This is not some government takeover. If you like your doctor, you can keep seeing your doctor. This is important. I don’t want government bureaucrats meddling in your health care, but I also don’t want insurance company bureaucrats meddling in your health care either. That’s what reform is about.”

9. Aug. 15, 2009: “Remarks By The President In Town Hall On Health Care Grand Junction Colorado”

“At the same time – I just want to be completely clear about this; I keep on saying this but somehow folks aren’t listening – if you like your health care plan, you keep your health care plan. Nobody is going to force you to leave your health care plan. If you like your doctor, you keep seeing your doctor. I don’t want government bureaucrats meddling in your health care. But the point is, I don’t want insurance company bureaucrats meddling in your health care either.”

10. Aug. 15, 2009: President’s “Weekly Address: President Obama Says Health Reform Will Put Patients’ Interests Ahead of Insurance Company Profits”

“First, no matter what you’ve heard, if you like your doctor or health care plan, you can keep it. If you don’t have insurance, you’ll finally be able to afford insurance. And everyone will have the security and stability that’s missing today.”

11. Aug. 20, 2009: “Remarks by the President at the Organizing for America National Health Care Forum”

“First, no matter what you’ve heard, if you like your doctor, you can keep your doctor under the reform proposals that we’ve put forward. If you like your private health insurance plan, you can keep it. If your employer provides you health insurance on the job, nobody is talking about messing with that. If you don’t have health insurance, we do intend to provide you high-quality, affordable options.”

12. Aug. 22, 2009: President’s “Weekly Address: President Obama Debunks ‘Phony Claims’ about Health Reform; Emphasizes Consumer Protections”

“I’ve said from the beginning, under the reform we seek, if you like your doctor, you can keep your doctor. If you like your private health insurance plan, you can keep your plan. Period. Now, the source of a lot of these fears about government-run health care is confusion over what’s called the public option.”

13. March 3, 2010: “Remarks by the President on Health Care Reform”

“Now, the proposal I put forward gives Americans more control over their health insurance and their health care by holding insurance companies more accountable. It builds on the current system where most Americans get their health insurance from their employer. If you like your plan, you can keep your plan. If you like your doctor, you can keep your doctor. I can tell you as the father of two young girls, I would not want any plan that interferes with the relationship between a family and their doctor.”

14. March 6, 2010: President’s “Weekly Address: Health Reform Will Benefit American Families and Businesses This Year”

“What won’t change when this bill is signed this: if you like the insurance plan you have now, you can keep it. If you like your doctor, you can keep your doctor. Because nothing should get in the way of the relationship between a family and their doctor.”

15. March 8, 2010: “Remarks by the President on Health Insurance Reform”

“And that’s why my proposal builds on the current system where most Americans get their health insurance from their employer. If you like your plan, you can keep your plan. If you like your doctor, you can keep your doctor. But I can tell you, as the father of two young girls, I don’t want a plan that interferes with the relationship between a family and their doctor. So we’re going to preserve that.”

16. March 10, 2010: “Remarks by the President at a Fundraising Dinner for Senator Claire McCaskill”

“But I don’t believe we should give the government or insurance companies more control over health care in America. I believe it’s time to give you, the American people, more control over your health insurance. And that’s why my proposal – my proposal builds on the current system, where most Americans get their health insurance from their employer. If you like your plan, you can keep your plan. If you like your doctor, you can keep your doctor. I’m the father of two young girls – I don’t want anybody interfering between my family and their doctor.”

17. March 10, 2010: “Remarks by the President on Health Insurance Reform in St. Charles, MO”

“So my proposal builds on the current system where most Americans get their health care from their employers. If you like your plan, you can keep your plan. If you like your doctor, you can keep your doctor. But my proposal would change three important things about the current health care system. Now I want everybody to pay attention – I know it’s a little warm in here, but I want you to pay attention, so that when you are talking to your friends and your neighbors and folks at work and they’re wondering what’s going on, I want you to be able to just say, here are the three things Obama is trying to do.”

18. March 15, 2010: “Remarks by the President on Health Care Reform in Strongsville, Ohio”

“And that’s what our proposal does. Our proposal builds on the current system where most Americans get their health insurance from their employer. So if you like your plan, you can keep your plan. If you like your doctor, you can keep your doctor. I don’t want to interfere with people’s relationships between them and their doctors.”

19. March 19, 2010: “Remarks by the President on Health Insurance Reform in Fairfax, Virginia”

“Now, I just – I just want to be clear, everybody. Listen up, because we have heard every crazy thing about this bill. You remember. First we heard this was a government takeover of health care. Then we heard that this was going to kill granny. Then we heard, well, illegal immigrants are going to be getting the main benefits of this bill. There has been – they have thrown every argument at this legislative effort. But when it – it turns out, at the end of the day, what we’re talking about is common-sense reform. That’s all we’re talking about.

If you like your doctor, you’re going to be able to keep your doctor. If you like your plan, keep your plan. I don’t believe we should give government or the insurance companies more control over health care in America. I think it’s time to give you, the American people, more control over your health.”

20. March 23, 2010: “Remarks by the President and Vice President on Health Insurance Reform at the Department of the Interior” (after signing Obamacare into law)

“I said this once or twice, but it bears repeating: If you like your current insurance, you will keep your current insurance. No government takeover; nobody is changing what you’ve got if you’re happy with it. If you like your doctor, you will be able to keep your doctor. In fact, more people will keep their doctors because your coverage will be more secure and more stable than it was before I signed this legislation.”

21. June 18, 2010: “Remarks by the President at DSCC/DCCC Fundraiser, 6/18/2009”

“And right now, we need the help of this Congress to finally pass reforms that bring down the crushing cost of health care and give every American an opportunity to get decent health care in this country. I gave a speech about this earlier in the week. When it comes to the cost of health care, the status quo is unsustainable. Inaction is no longer an option. If we do nothing, more families will go bankrupt, more businesses will shut their doors, more debt will be passed on to our children.It’s time to fix what’s broken about our health care system and build on what works. And I’ve said this before – if you like your doctor, you should be able to keep your health care. If you like your health care plan, you should be able to keep it. But we need a system where every American can finally afford their health care.”

It is clear that President Obama made various statements that one could keep their doctor, however a question arises as to why he would say such statements when soon after it became clear those statements weren’t true. Although President Obama’s intention in making those statements is unclear, he eventually refined his message after Obamacare passed and some lost their coverage.

On Nov. 4, 2013, President Obama explained:

“Now, if you have or had one of these plans before the Affordable Care Act came into law and you really liked that plan, what we said was you can keep it if it hasn’t changed since the law passed. So we wrote into the Affordable Care Act, you’re grandfathered in on that plan. But if the insurance company changes it, then what we’re saying is they’ve got to change it to a higher standard. They’ve got to make it better, they’ve got to improve the quality of the plan that they’re selling.

That’s part of the promise that we made too. That’s why we went out of our way to make sure that the law allowed for grandfathering, but if we had allowed these old plans to be downgraded, or sold to new enrollees once the law had already passed, then we would have broken an even more important promise – making sure that Americans gain access to health care that doesn’t leave them one illness away from financial ruin. The bottom line is that we are making the insurance market better for everybody and that’s the right thing to do.”“Obama: “What We Said Was You Can Keep It If It Hasn’t Changed Since The Law Passed,” Transcript from video on RealClearPolitics.com, Nov. 4, 2013

As some Americans lost their health plans despite President Obama’s assurances, Chuck Todd of NBC News explicitly asked the president, “do you feel like you owe these folks an apology for misleading them?”“VIDEO: Watch Obama (kinda, sorta) Apologize to Americans’ Losing Their Health Plans,” WashingtonPost.com, Nov. 7, 2013 The president answered:

“You know – I regret very much that – what we intended to do, which is to make sure that everybody is moving into better plans because they want ’em, as opposed to because they’re forced into it. … Keep in mind that most of the folks who are going to – who got these c– cancellation letters, they’ll be able to get better care at the same cost or cheaper in these new marketplaces. Because they’ll have more choice. They’ll have more competition. They’re part of a bigger pool. Insurance companies are going to be hungry for their business.

So – the majority of folks will end up being better off, of course, because the website’s not working right. They don’t necessarily know it right. But it – even though it’s a small percentage of folks who may be disadvantaged, you know, it means a lot to them. And it’s scary to them. And I am sorry that they – you know, are finding themselves in this situation, based on assurances they got from me.”“Obama: ‘I Am Sorry They Are Finding Themselves In This Situation’,” WashingtonTimes.com, Nov. 7, 2013, and YouTube.com video of remarks, accessed 7/14/2017

Appendix B: Compromise Deals to Gain Votes for the ACA

In order to get the votes to pass H.R. 3590 in its earliest stages, some compromises for certain states were made from the Nov. 21, 2009, vote that led to the Dec. 24, 2009, Senate vote which led to H.R. 3590 being passed by the House and enacted on March 23, 2010.

The following are details on two of the more notable deals known as the “Louisiana Purchase” and the “Cornhusker Kickback”:

Louisiana Purchase

On Nov. 21, 2009, Rep. Mary Landrieu [D-LA] was among the 59 Democrats and 1 Independent“Roll Call Vote 111th Congress – 1st Session,” Senate.gov, accessed 7/13/2017 to vote to “invoke cloture” and proceed with debate on H.R. 3590.“Public Opinion And Health Reform: Looking At Hot-Button House-Senate Differences,” HealthAffairs.org, Dec. 15, 2009

Rep. Landrieu pushed for a provision for her state of Louisiana, which was at the request of Republican Gov. Bobby Jindal, referred to as the “Louisiana Purchase.”“Sen. Landrieu Defends ‘Louisiana Purchase,’ Says Jindal Asked for It,” TheHill.com. Feb. 4, 2010 On Congress.gov, the text in the bill for Nov. 19, 2009 states: “Sec. 2006. Special adjustment to FMAP determination for certain States recovering from a major disaster.”

On Nov. 21, 2009, Rep. Landrieu made a floor statement during a Senate Session on health care reform on C-SPAN: “My vote today to move forward on this important debate should in no way be construed by the supporters of this current framework as an indication of how I might vote as this debate comes to an end. It is a vote to move forward to continue the good and essential and important and imperative work that is under way. …”

In that same speech, she also said that extra dollars flowing in from Hurricane Katrina’s reconstruction “made us seem as if we were Connecticut and not Louisiana. Like we had … overnight become rich. That is not the case … it is not a $100 million fix. It’s a $300 million fix. And it is the number one request of my governor, who is a Republican. And it is unanimously supported by every member of our delegation, Democrat and Republican. I’m proud to have asked for it.”

On Feb. 4, 2010, Rep. Landrieu defended the provision stating, “Nothing about this effort was secret. Nothing. … I think the editors of our newspapers would be very interested since they’ve been reporting on it since the first meeting on January 11, 2009.”“Senator Landrieu on Health Care,” C-SPAN Transcript, accessed 7/13/2017

Rep Landrieu also clarified, “[B]ut never did I say at any time that if this wasn’t in the bill that I wouldn’t vote for it or if it was in the bill that I would vote for it.”YouTube.com Fox News Channel video from Feb. 4, 2010, accessed 7/13/2010

Although not named by state, Rep. Landrieu’s provision was not cut from the ACA. Text in the enacted Public Law No: 111-148 for H.R. 3590 signed by President Obama on March 23, 2010, contains the following provision: “SEC. 2006. Special adjustment to FMAP determination for certain states recovering from a major disaster.”

Cornhusker Kickback

Nebraska Democratic Senator Ben Nelson is reported to have received from Senate Majority Leader Harry Reid (D-NV) what was dubbed the “Cornhusker kickback,” on Dec. 19, 2009,Peter Sullivan, “ObamaCare on his mind,” TheHill.com, Sept. 30, 2014 in exchange for his Dec. 24, 2009, Senate vote on H.R. 3590.“Frontline: Obama’s Deal: Chronology,” PBS.org, accessed 7/13/2017

Sen. Nelson spoke about the “so-called Medicaid fix for the State of Nebraska” about “the ‘Omaha Stakes’ fix” and “special deal” on Dec. 22, 2009, during a Senate meeting on H.R. 3590, explaining, “It is not a special deal for Nebraska. It is, in fact, an opportunity to get rid of an unfunded Federal mandate for all the states. Let me repeat that: for all the States. There is nothing special about it, and it is fair.”Congressional Record, accessed 7/13/2009

Sen. Nelson voted for H.R. 3590 on Dec. 24, 2009.GovTrack.us, accessed 7/13/2017 On Jan. 15, 2010, Sen. Nelson wrote to Reid:

“After raising the issue of the unfunded mandate during Senate negotiations, a provision was added to exempt the State of Nebraska from paying any additional Medicaid funds as a result of the bill. … I request that this specific exemption for the State of Nebraska be removed, and that it instead be replaced with a provision giving all state governments the same treatment regarding the state match for the new Medicaid expansion.”David M. Drucker, “Nelson Asks Reid to Drop Medicaid Break for Nebraska,” RollCall.com, Jan. 15, 2010

This provision did not make it into the final ACA passage on March 21, 2010.The Rachel Maddow Show, “There Is No ‘Cornhusker Kickback’,” MSNBC.com, March 28, 2012

Appendix C: 19 Taxes, Penalties, Fees, Revenue Enhancements, and Deduction Eliminations in ObamacareReprinted with permission of ProCon.org, a 501(c)(3) nonprofit public charity, on 7/27/2017

In all, Obamacare had 12 new or increased taxes and fees, and seven lowered or eliminated tax benefits and credits. The PPACA contains 12 of those revenue generators, the Reconciliation Act contains four, and three are found in both.

The following 19 taxes, penalties, fees, revenue enhancements, and deduction eliminations also have citations, brief descriptions, and relevant passages from the ACA (Obamacare).

1. Bill: PPACA

Sec. 9007. Additional Requirements for Charitable Hospitals

Sec. 10903. Modification of Limitation on Charges by Charitable Hospitals

Sec. 4959. Taxes on Failures by Hospital Organizations

Tax Penalty for Non-Compliance:

Amends the Internal Revenue Code of 1986 to add additional requirements for hospitals wishing to file as 501(r)(3) charities, and taxes those hospitals $50,000 if they fail to meet the requirements. The requirements include conducting a community health needs assessment and implementing a strategy to meet those needs; establishing a written financial assistance policy; establishing a policy to provide emergency care without discrimination; limiting charges for “emergency or other medically necessary care” for individuals eligible for financial assistance.

“If a hospital organization to which section 501(r) applies fails to meet the requirement of section 501(r)(3) for any taxable year, there is imposed on the organization a tax equal to $50,000.”

2. Bill: Reconciliation Act

Sec. 1409. Codification of Economic Substance Doctrine and Penalties

Codifying Existing Common Law Doctrine and Tax Penalty for Non-Compliance:

If a taxpayer performs a transaction that the IRS deems to lack “economic substance” or “a business purpose” (i.e. merely to lower one’s tax burden), that transaction is now penalized at a tax rate of 40% if undisclosed (an increase from the existing rate of 20%). The “economic substance doctrine” was a well-established common law doctrine that Obamacare codified in American tax law.

“(5) DEFINITIONS AND SPECIAL RULES.—For purposes of this subsection—

(A) ECONOMIC SUBSTANCE DOCTRINE.—The term ‘economic substance doctrine’ means the common law doctrine under which tax benefits under subtitle A with respect to a transaction are not allowable if the transaction does not have economic substance or lacks a business purpose.”